"Key Drivers Impacting Executive Summary Middle East and Africa Tax IT Software Market Size and Share

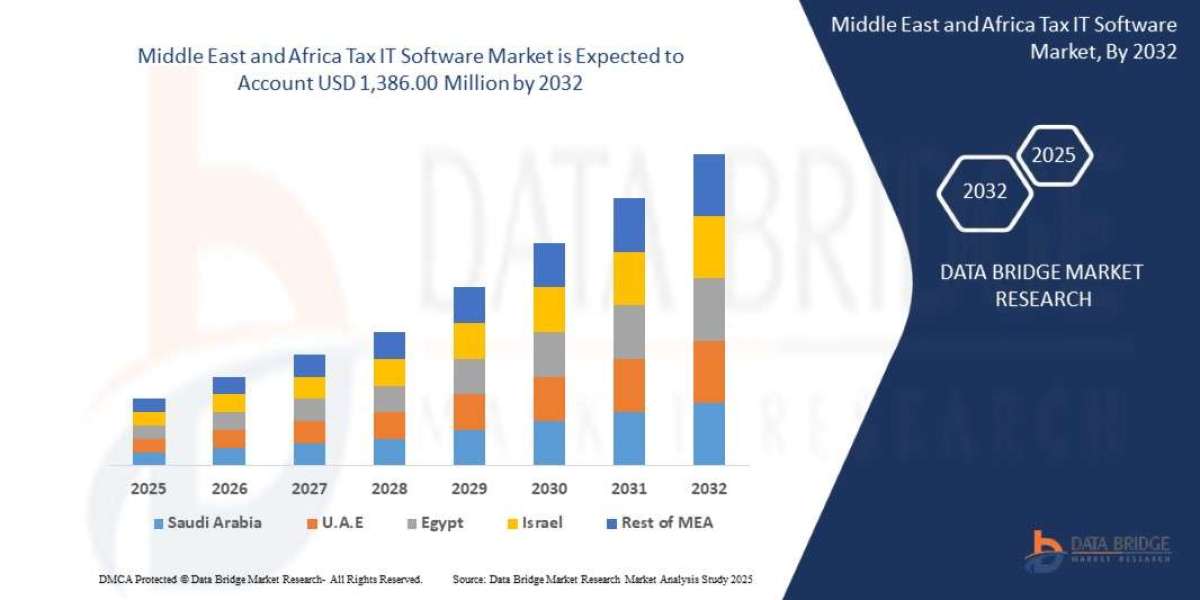

Data Bridge Market Research analyses that the tax the Middle East and Africa tax IT software market is expected to reach USD 1,386.00 million by 2032 from USD 855.75 million in 2024 growing with a CAGR of 8.1% in the forecast period of 2025 to 2032.

The credible Middle East and Africa Tax IT Software Marketreport comprises of various segments linked to Middle East and Africa Tax IT Software Market industry and market with comprehensive research and analysis. Market research analysis and insights covered in this report are very considerate for the businesses to make better decisions, to develop better strategies about production, Market, sales and promotion of a particular product and thereby extending their reach towards the success. Businesses can achieve unrivalled insights and acquaintance of the best market opportunities into their respective markets with the help of Middle East and Africa Tax IT Software Market analysis report. The market report estimates the growth rate and the market value based on market dynamics and growth inducing factors.

With the specific base year and the historic year, estimations and calculations are performed in the steadfast Middle East and Africa Tax IT Software Market This global market report is generated based on the market type, size of the organization, availability on-premises and the end-users’ organization type, and the availability in areas such as North America, South America, Europe, Asia-Pacific and Middle East & Africa. The report focuses on major driving factors of the market and the market restraints which generally causes inhibition. An all-inclusive Middle East and Africa Tax IT Software Market report conducts the market overview with respect to general market conditions, market improvement, market scenarios, development, cost and profit of the specified market regions, position and comparative pricing between major players.

Understand market developments, risks, and growth potential in our Middle East and Africa Tax IT Software Market study. Get the full report:

https://www.databridgemarketresearch.com/reports/middle-east-and-africa-tax-it-software-market

Middle East and Africa Tax IT Software Industry Trends

*Segments*

- By Component: Software, Services

- By Deployment Type: Cloud-based, On-premises

- By Enterprise Size: Small and Medium-sized Enterprises (SMEs), Large Enterprises

- By End-User: Individuals, Enterprises

The Middle East and Africa Tax IT Software Market is segmented based on various factors such as component, deployment type, enterprise size, and end-user. In terms of components, the market consists of software and services, providing a range of options for consumers to choose from based on their specific requirements. Deployment types include cloud-based solutions, offering flexibility and scalability, and on-premises installations for organizations preferring complete control over their systems. The market caters to both small and medium-sized enterprises (SMEs) as well as large enterprises, ensuring that businesses of all sizes can benefit from tax IT software solutions. Furthermore, the market serves individuals and enterprises, addressing the diverse needs of different user groups.

*Market Players*

- Avalara, Inc.

- Sovos Compliance, LLC

- Thomson Reuters

- Wolters Kluwer

- Intuit Inc.

- H&R Block

- Blucora, Inc.

- Vertex, Inc.

- Xero Limited

- TaxSlayer LLC

Key market players in the Middle East and Africa Tax IT Software Market include Avalara, Inc., Sovos Compliance, LLC, Thomson Reuters, Wolters Kluwer, Intuit Inc., H&R Block, Blucora, Inc., Vertex, Inc., Xero Limited, and TaxSlayer LLC. These companies offer a wide range of tax IT software solutions tailored to meet the specific needs of businesses and individuals in the region. With a focus on innovation and technology, these market players continue to drive advancements in tax IT software, providing efficient and effective solutions for tax compliance and management in the Middle East and Africa region.

The Middle East and Africa Tax IT Software Market is witnessing significant growth driven by several key factors. One notable trend in the market is the increasing adoption of cloud-based tax IT software solutions. Cloud-based deployments offer advantages such as cost-efficiency, scalability, and remote accessibility, making them an attractive option for businesses looking to streamline their tax processes. This shift towards cloud solutions is expected to drive market growth as more organizations recognize the benefits of cloud technology in tax management.

Another important aspect of the market is the emphasis on catering to the specific needs of different enterprise sizes. Small and medium-sized enterprises (SMEs) form a significant portion of the market, and tax IT software providers are offering tailored solutions to meet the unique requirements of these businesses. By offering customizable and scalable software options, vendors are able to address the distinct challenges faced by SMEs in tax compliance and reporting. On the other hand, large enterprises are also a key segment as they require robust and comprehensive tax IT solutions to manage complex tax structures and regulations across multiple jurisdictions.

Moreover, the market players mentioned are driving innovation and competition in the Middle East and Africa Tax IT Software Market. Companies like Avalara, Inc., Thomson Reuters, and Wolters Kluwer are investing in research and development to enhance their software offerings with advanced features such as AI-driven automation, real-time reporting capabilities, and predictive analytics. These technological advancements are aimed at improving the accuracy and efficiency of tax processes, ultimately providing users with a more seamless experience in managing their tax obligations.

Furthermore, the market is witnessing a growing demand for user-friendly and intuitive tax IT software solutions. As more individuals and businesses seek to simplify their tax-related tasks, there is a rising need for software that is easy to use and navigate. Market players are focusing on developing user-centric interfaces and tools that empower users to handle tax compliance with minimal effort. By prioritizing user experience and feedback, vendors are enhancing the usability of their software offerings, thus increasing customer satisfaction and retention rates.

In conclusion, the Middle East and Africa Tax IT Software Market is evolving rapidly, driven by trends such as cloud adoption, tailored solutions for different enterprise sizes, technological innovation by key market players, and a focus on user-friendly interfaces. As the market continues to expand and mature, businesses and individuals in the region can expect a diverse range of advanced tax IT software solutions that cater to their specific needs and requirements.The Middle East and Africa Tax IT Software Market is a dynamic landscape with various factors influencing its growth and development. One key trend shaping the market is the increasing adoption of cloud-based solutions. Cloud technology offers benefits such as cost-efficiency, scalability, and remote accessibility, making it an attractive choice for organizations seeking to streamline their tax processes. The convenience and flexibility provided by cloud-based deployments are driving market growth as more businesses recognize the value of cloud solutions in managing their tax compliance requirements efficiently.

Moreover, the market's segmentation based on enterprise size is crucial in addressing the diverse needs of different businesses in the region. Small and medium-sized enterprises (SMEs) constitute a significant portion of the market, and tax IT software providers are offering tailored solutions to suit their specific requirements. By providing customizable and scalable software options, vendors can assist SMEs in overcoming the unique challenges they face in tax compliance and reporting. On the other hand, large enterprises require comprehensive solutions to manage complex tax structures and regulations across multiple jurisdictions, driving the demand for robust tax IT software offerings.

Furthermore, market players like Avalara, Inc., Thomson Reuters, and Wolters Kluwer are at the forefront of driving innovation in the Middle East and Africa Tax IT Software Market. These companies are investing in research and development to enhance their software solutions with advanced features such as AI-driven automation, real-time reporting capabilities, and predictive analytics. By leveraging technology and data-driven insights, these key players are improving the accuracy and efficiency of tax processes for businesses and individuals, thus enhancing the overall user experience in tax management.

Additionally, there is a growing demand for user-friendly and intuitive tax IT software solutions in the market. As individuals and businesses seek to simplify their tax-related tasks, software providers are focusing on developing interfaces and tools that are easy to use and navigate. By prioritizing user experience and incorporating feedback-driven design principles, market players are enhancing the usability of their solutions, ultimately leading to higher customer satisfaction and retention rates. This emphasis on user-centric design is shaping the future of tax IT software by making it more accessible and user-friendly for a wider audience.

In conclusion, the Middle East and Africa Tax IT Software Market is characterized by trends such as cloud adoption, tailored solutions for different enterprise sizes, technological innovation by key market players, and a focus on user-friendly interfaces. These trends are reshaping the market landscape and driving the evolution of advanced tax IT software solutions that cater to the specific needs of businesses and individuals in the region. As the market continues to mature, stakeholders can expect continued advancements in technology and usability, ultimately enhancing the efficiency and effectiveness of tax compliance and management processes in the Middle East and Africa.

Break down the firm’s market footprint

https://www.databridgemarketresearch.com/reports/middle-east-and-africa-tax-it-software-market/companies

Middle East and Africa Tax IT Software Market Reporting Toolkit: Custom Question Bunches

- What’s the present market valuation for the Middle East and Africa Tax IT Software Market sector?

- What is the estimated yearly growth outlook?

- What segment types are elaborated in the study?

- Who are the main stakeholders in the Middle East and Africa Tax IT Software Market?

- What are the newest innovations introduced by companies?

- What regional data points are considered?

- What region shows rapid development?

- Which nation is forecasted to lead the Middle East and Africa Tax IT Software Market industry?

- What region dominates in Middle East and Africa Tax IT Software Market revenue?

- Which country is experiencing the steepest Middle East and Africa Tax IT Software Market growth curve?

Browse More Reports:

Asia-Pacific Industrial Hoses Market

Europe Industrial Hoses Market

North America Industrial Hoses Market

Europe Thermocouple Temperature Sensors Market

Middle East and Africa Thermocouple Temperature Sensors Market

Asia-Pacific Thermocouple Temperature Sensors Market

North America Thermocouple Temperature Sensors Market

Germany Advanced Wound Care Market

U.S. Warts Treatment Market

Europe Human Leukocyte Antigens (HLAs) Typing Transplant Diagnostics Services Market

North America Prescription Digital Therapeutics (PDTx) Market

Asia-Pacific Prescription Digital Therapeutics (PDTx) Market

Europe Prescription Digital Therapeutics (PDTx) Market

Middle East and Africa Prescription Digital Therapeutics (PDTx) Market

Middle East and Africa Dandruff Treatment Market

North America Dandruff Treatment Market

Europe Capric/Caprylic Triglycerides Market

Middle East and Africa Caprylic/Capric Triglycerides Market

North America Consumer Electronics Packaging Market

Asia-Pacific Lentiviral Vector Market

Middle East and Africa Lentiviral Vector Market

North America Lentiviral Vector Market

Middle East Advanced Wound Care Market

Middle East and Africa Smoke Detector Market

Asia-Pacific Smoke Detector Market

Global Near Field Communications Cover Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com